If you are putting off moving because you think that home prices will go down, you may want to rethink this strategy. There are a number of factors that have all experts predicting home prices continuing to rise. While the market may cool, and prices will likely not be going up by the soaring amounts that we saw in 2020 and 2021, {locally upwards of 20%}, make no mistake they are continuing to rise. Let's discuss the factors that come into play, latest data, and what strategies we think will be winners in the last quarter of 2023, and into 2024.

But what if prices drop?

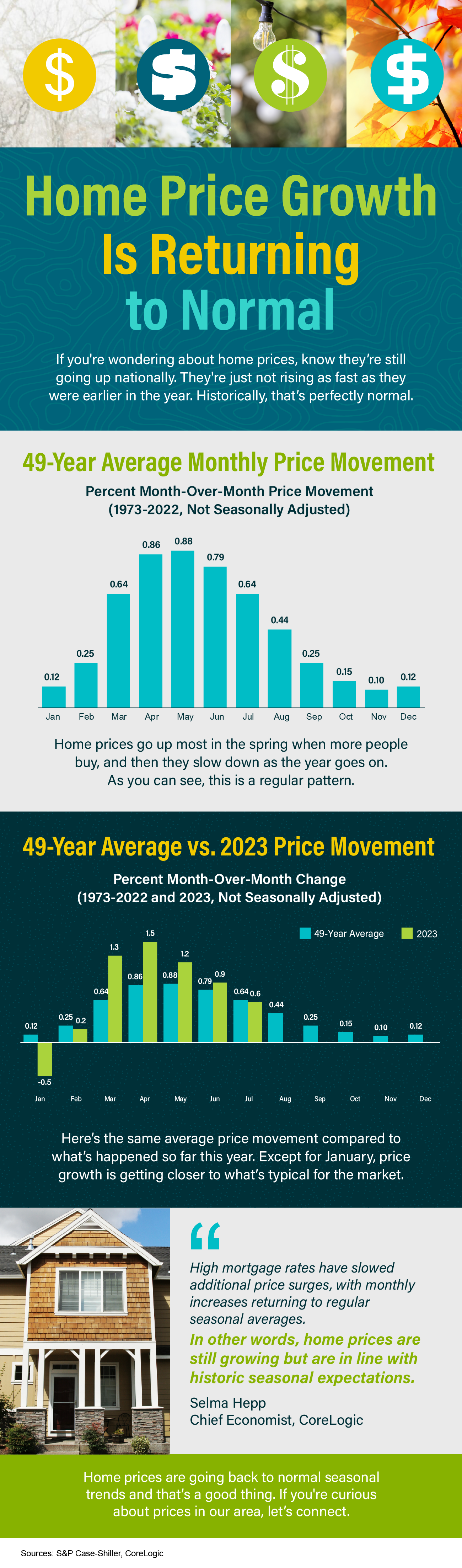

If you put off moving because you're worried home prices might drop, you may want to rethink this strategy. Despite a massive increase in prices and the market correction in 2022, all data points to continued sustained increases in pricing. In the first half of 2022, home prices rose significantly, at an unsustainable rate, whereas in the second half of the year, prices went through a correction and started dipping a bit. In 2023, prices are going up again, but this time at a more normal pace.

Orphe Divounguy, Senior Economist at Zillow, explains changing home prices well in her statement, "The U.S. housing market has surged over the past year after a temporary hiccup from July 2022-January 2023. . . . That downturn has proven to be short-lived as housing has rebounded impressively so far in 2023. .."

Why will increases in pricing be sustained?

One reason why home prices are going back up is inventory. Inventory, especially in the Research Triangle Park, has been constricted for years now. While there are many developers rushing to build units and single family homes, there is still a constricted market. Another element to consider here, that a lot of media pay attention to is a decreased demand due to mortgage rates. Even though higher mortgage rates cause buyer demand to moderate, they also cause the supply of available homes to go down. When rates rise, some homeowners are reluctant to sell and lose their current low mortgage rate just to take on a higher one for their next home. This is because home mortgage rates impact both a buyer and a seller.

"While rising interest rates have reduced affordability and therefore demand;they have also reduced supply through the mortgage rate lock-in effect. Overall, it appears the reduction in supply has outweighed the decrease in demand, thus house prices have started to increase . . ."- Freddie Mac

But What If the Market Crashes?

Some housing experts projected home prices were going to crash in 2023.All of this negative coverage made many people doubt the strength of the market and potentially delay moves, however it did not crash and we see buyers who wish they had locked in a lower mortgage rate and lower price on homes. Data showed that home prices were in fact resilient and performed far better than the media would have you believe. The declines that did happen, weren't drastic but were short-lived.

As Nicole Friedman, a reporter at the Wall Street Journal (WSJ), says:

"Home prices aren't falling anymore. . . The surprisingly quick recovery suggests that the residential real-estate downturn is turning out to be shorter and shallower than many housing economists expected . . "

Home Price Growth Is Returning to Normal

Home Prices in 2024

The consensus from experts is that home price growth will continue in the years ahead and is returning to normal levels for the market. That means we'll still see home prices appreciating, just at a slower pace than the last few years and that's a good thing. Of course we are going to see news sources that will report prices are falling and we could be facing a crash, but the reality in the Triangle, and remember real estate is location specific, we do not see this coming anytime in the next 5 year period.

Further, the Consumer Confidence data indicates that consumers are confident in the housing market. Ultimately, you have to consult with a licensed and experienced Realtor to understand what is happening in the real estate market you are looking to buy in. National headlines truly do not apply to your local search and purchase, and the reality is that both sellers and buyers should be making moves now, to avoid higher rates later. Contact My NC Homes to get a full and detailed picture of your personal real estate forecast. With over six decades of experience, we can forecast the best outcomes for our clients.

Posted by Larry Tollen on

Leave A Comment