What's The Difference Between Buying Condos and Townhomes In North Carolina?

Posted by Larry Tollen on

Working with as many home-buyers as I do, I wanted to explain the difference between condominiums and townhomes and why it matters in terms of financing as well as specific legal issues here in North Carolina.

Kensignton Trace is a popular condominium with UNC graduate students and young familes development in Chapel Hill NC If you’re reading this and looking to buy in any other state you should really check with a local Realtor regarding how your specific state views these two forms of real estate. While much of the information I’m sharing below is likely to apply, I know it’s different in every state and these differences could be quite significant.

Understanding The Difference Between Condos & Townhomes

What's the difference between the two —…

12729 Views, 4 Comments

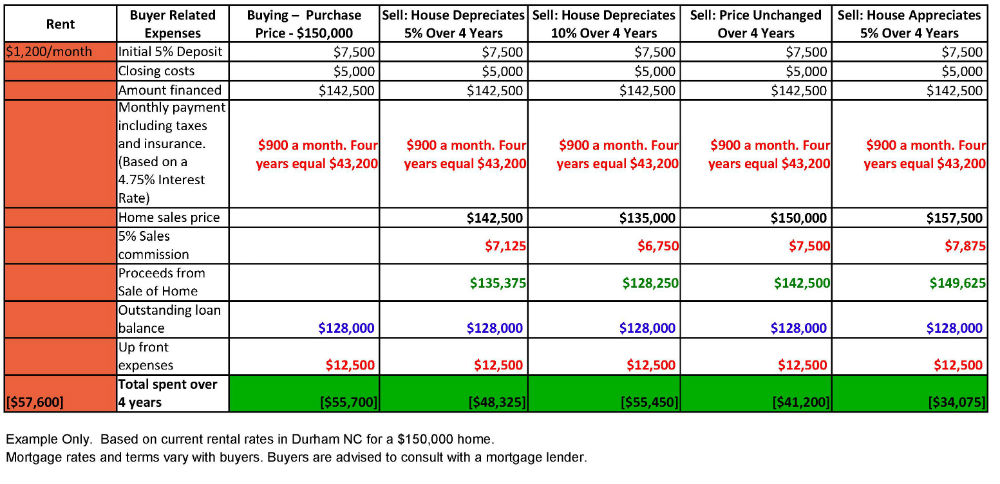

Most of us who wish to buy a home will do so by getting a mortgage. The first requirement is that we manage to save up enough money for a down payment. In addition, there are many other costs when purchasing a home — collectively referred to as “closing costs” which may include: mortgage application fees, attorney fees, inspection fees, home owners and title insurance, property tax and possibly homeowner association pro-rations, filing fees, and others. Equally important is having a good enough credit score to qualify for a mortgage and, unlike saving up your money which everyone understands, very often many people don't really understand how this works and what it will mean and how to improve their scores. If you are one of these folks, this is the…

Most of us who wish to buy a home will do so by getting a mortgage. The first requirement is that we manage to save up enough money for a down payment. In addition, there are many other costs when purchasing a home — collectively referred to as “closing costs” which may include: mortgage application fees, attorney fees, inspection fees, home owners and title insurance, property tax and possibly homeowner association pro-rations, filing fees, and others. Equally important is having a good enough credit score to qualify for a mortgage and, unlike saving up your money which everyone understands, very often many people don't really understand how this works and what it will mean and how to improve their scores. If you are one of these folks, this is the… Buying Foreclosures; not a week that goes by that I don’t receive one or more calls or e-mails from hopeful buyers and/or investors wanting to buy a bank-owned property (a foreclosure). I always start the conversation with a simple question, “Why do you want to buy a foreclosure?” More often than not I get a version of the following as an answer. “The price. I know foreclosures are a good deal.” As someone who specializes in buyer brokering, I will admit I inwardly cringe a little every time I hear this as I rarely find foreclosures to be the deal most people think they are.

Buying Foreclosures; not a week that goes by that I don’t receive one or more calls or e-mails from hopeful buyers and/or investors wanting to buy a bank-owned property (a foreclosure). I always start the conversation with a simple question, “Why do you want to buy a foreclosure?” More often than not I get a version of the following as an answer. “The price. I know foreclosures are a good deal.” As someone who specializes in buyer brokering, I will admit I inwardly cringe a little every time I hear this as I rarely find foreclosures to be the deal most people think they are.