What you should know about closing costs? A LOT! Buyers need to understand the costs and timelines associated with purchasing a home, or better be working with an experienced, reputable Realtor to explain details. When you start saving for a home or putting money aside for a down payment, the closing costs may not immediately come to mind. Closing costs include the items listed below and in some states Buyers are required to pay the state a "tax" on the purchase as well. Let's break these down so you are not learning about closing costs, the hard way.

What you should know about closing costs? A LOT! Buyers need to understand the costs and timelines associated with purchasing a home, or better be working with an experienced, reputable Realtor to explain details. When you start saving for a home or putting money aside for a down payment, the closing costs may not immediately come to mind. Closing costs include the items listed below and in some states Buyers are required to pay the state a "tax" on the purchase as well. Let's break these down so you are not learning about closing costs, the hard way.

Seller closing expenses include the commission they agreed to pay their listing agent which is typically split with the Buyer's Broker and in NC and many other states the seller pays a tax on the sale of the property. In North Carolina this tax is .002% of the sale price. Example Sale price is $400,000, the tax due at closing would be $800. Another common closing cost for sellers will be for prorated taxes for the year, and possibly any buyer credits for repairs related to the buyers inspections.

What are closing costs?

According to Freddie Macclosing costs are a collection of fees and payments involved in your transaction. They vary by location and situation but generally include the following.

- Government recording costs

- Appraisal fees

- Credit report fees

- Lender origination fees

- Title services

- Tax service fees

- Survey fees

- Attorney fees

- Underwriting Fees

- Flood Hazard Certification

- Balance of any amount not being financed and not covered by the buyers earnest money or due diligence deposits.

Depending on where you live and who is financing your loan, the closing costs will vary by governing laws for real estate and fees relating to lending and title transfers. These are not small amounts. The closing fees for the transfer of property includes a number of parties and your Realtor should have an idea of what the average closing fees are for a property. Your Lender is required to give you a required estimation of money need to close within 3 days of your making a formal loan application and if certain fees were to come in higher, than estimated, the lender is required to make up the difference.

Budgeting for Closing

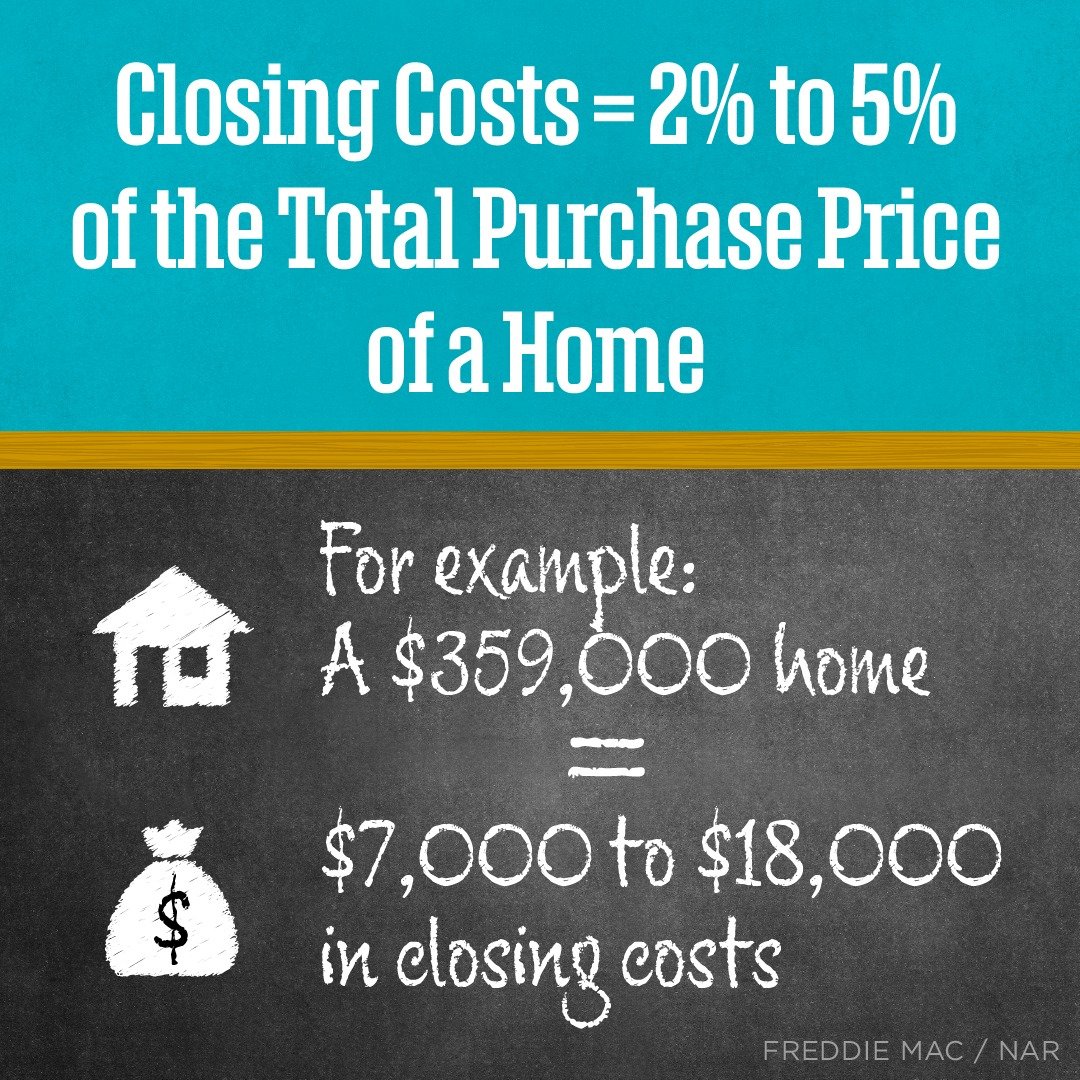

A rule of thumb, according to the above-mentioned Freddie Mac article, is to reserve 2-5% of the total price of the home for settling closing fees. Based on this estimate if your budget for a home is around $350000, you would need another $7000-$17500 for closing. This is a large swing as you can see, so it is really important that you account for the closing fees. Where homes are more expensive, costs similarly increase. Creating a budget that airs on the side of caution is imperative when you are shopping for real estate. One of the strategies that we suggest is shopping for homes under your budget so you are able to have room in the budget to account for closing costs. The most important strategy you can employ is hiring an experienced Realtor.

My NC Homes has decades of local experience in The Research Triangle Park. We have an expert level of knowledge of local regulations and fees and who are the best lenders, lawyers, and title companies, to make your transaction seamless. More homes are coming to the market and we are happy to advise you and get you started toward a happier housing future. Contact My NC Homes today!

Posted by Larry Tollen on

Leave A Comment