The "American Dream" foundation is often, homeownership. It signifies stability, independence, and attainment of a place of ones own. However, for Generation Z, born between 1997 and 2012, there are significant barriers to homeownership in the present market and making this dream a reality can be quite challenging because of higher mortgage rates and higher home prices than previous generations. This should not deter a whole generation from homebuying, because even outside of the "dream" it is a great way to stabilize your finances and build wealth and owning your first home can be attainable with the right strategic planning and resourcefulness.

Down Payment Assistance Programs

While home prices are not on the meteoric rise that they had been post pandemic, in the Triangle, the are substantially increased and the inventory is constricted. Saving for a down payment might seem like an insurmountable task, however there are assistance programs for home buyers that can significantly reduce the upfront costs of buying a home.

According to Down Payment Resource, there are over 2,000 programs designed to assist aspiring homeowners with down payments and closing costs. If you are thinking about buying, contact a local Realtor and find out what programs are available to first time homebuyers in your area, and see what steps you should take to apply.

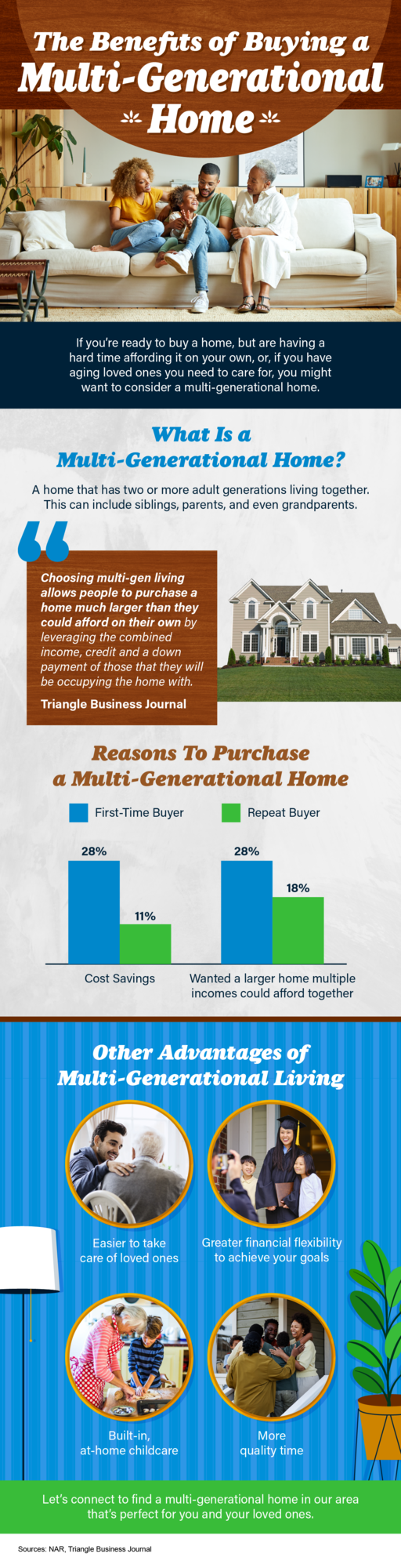

Multigenerational Housing

Even with the assistance of down payment programs, there are more strategies you can implement to save for a down payment. Whether this looks like living with relatives or choosing to have roommates, many Gen Z have chosen to live with relatives, expediting their savings goals. In fact, According to the National Association of Realtors (NAR), approximately 30% of Gen Z homebuyers transition directly from their relatives' homes to their own homes.

Even with the assistance of down payment programs, there are more strategies you can implement to save for a down payment. Whether this looks like living with relatives or choosing to have roommates, many Gen Z have chosen to live with relatives, expediting their savings goals. In fact, According to the National Association of Realtors (NAR), approximately 30% of Gen Z homebuyers transition directly from their relatives' homes to their own homes.

Through shared living costs, including mortgage payments, utilities, and even groceries, you stand to reduce monthly, freeing up more of your income to address debts, improve your credit score, and reach your down payment target more quickly. More and more multigenerational living situations that benefit both parents who might be faced with rising costs of living and children looking to save are being realized in the Research Triangle Park.

Z Road to Homeownership

For Generation Z, the path to homeownership can be within reach with the proper strategies. Thinking ahead and looking at homebuyer programs for first time homebuyers, prior to making decisions to move in with family, can be a great strategy. The 20% down payment amount may also actually not be as high, depending on the programs you qualify for. Your most valuable resource as a young homebuyer is a real estate agent with experience and knowledge of what is available to you. In the long term, stabilizing housing costs and building equity are a dream worth aspiring to.

Posted by Larry Tollen on

Leave A Comment