Are you considering a reverse mortgage? Do you know what a reverse mortgage is? Is it the same as refinancing? In the past decade reverse mortgages have gained in popularity, but we have also witnessed a rise in fraudulent and predatory practices within this industry. It has been pushed to seniors as a catch-all financial retirement product. However, it is important to understand that in reality it's a loan and when used to cover living, medical or other expenses you must understand that you are reducing the equity in your home. Applied without careful consideration, it can put your finances in a much worse position than other options that may be available to you. Let's explore the reverse mortgage and see if this is an option that makes sense for you.

What is a Reverse Mortgage

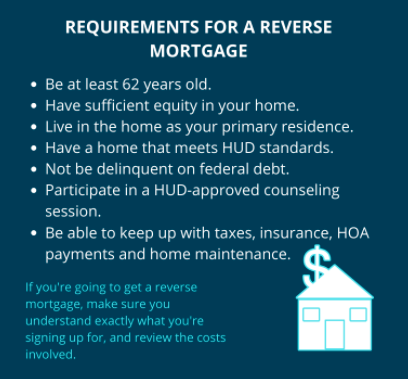

A Reverse Mortgage is a type of home loan only for homeowners who are 62 and older. It allows homeowners to borrow money using their homes as security against the loan. Like a traditional mortgage, when you take out a reverse mortgage loan, the title to your home remains in your name, but you don't make monthly mortgage payments, instead, the loan is repaid when the borrower no longer lives in the home. Conditions include Interest and fees added to the loan balance monthly. Homeowners continue to pay property taxes and homeowners insurance, must use the property as their primary residence and keep the property in good condition. A Home Equity Conversion Mortgage (HECM) is the most common type of reverse mortgage offered for those over age 62. The amount the homeowner owes to the lender increases over time because interest and fees are added to the loan balance each month, decreasing your home equity and depending on the future value of your home (an unknown) it's possible that when the home is sold after the homeowner moves out or passes away, your estate may in fact still owe the lender money.

3 Types of Reverse Mortgage

There are three types of reverse mortgages and are used for a variety of purposes from home repairs, to retirement, to private loans. As with all loans, you must consider the mortgage rate and fees when applying as these will make a big difference in cost over the duration of a loan. Reverse Mortgages, unlike home equity loans, are not fixed rate, so you could end up paying a lot more in equity than you initially planned. Also, be wary of who you are taking advice from when considering a reverse mortgage as there is a definite risk that you could end up being scammed. We strongly advise seeking advice from an outside party that has no skin in the game and not relying on the loan officer who is invested in getting you to sign on the dotted line.

-

Single-purpose reverse mortgages. A single-purpose reverse mortgage is a type of mortgages offered by some states and nonprofits. They

are typically awarded to low to moderate-income borrowers. These local solutions are used only for home repairs, improvements, or property taxes.

are typically awarded to low to moderate-income borrowers. These local solutions are used only for home repairs, improvements, or property taxes. -

Federally Insured Reverse Mortgages: The U.S. Department of Housing and Urban Development (HUD) back these loans, called Home Equity Conversion Mortgages or (HECMs). These are the most common and widely available, expensive, and do not require income or medical requirements. These are most expensive because they have insurance premiums that make increase your costs.

-

Proprietary Reverse Mortgages: These are private loans backed independently. These need to be vetted very carefully. See consumer reports and check the fiscal health of the company. Sadly, there are many companies that prey on those looking to finance their retirement using equity in their homes.

Funds and Fees of Reverse Mortgages

There are a number of options to get funds from a reverse mortgage. You can get a lump sum payment, you can receive payments monthly, you can do a hybrid of monthly payments and a lump sum, you may have a line of credit, or any combination of these. If you are considering downsizing and moving into a continuum living facility, this can provide funds, if they are not readily available, however, consider some of the fees. The origination fees, real estate appraisal fee, mortgage insurance premium, and variable interest rate make these a more expensive loan choice than conventional home equity line of credit.

Reverse Mortgage vs Conventional Mortgage

In a reverse mortgage, a lender makes payments to the borrower monthly, in a lump sum, or in the form of a credit line using the existing equity in their home. The remaining balance in equity is repaid when the borrower dies, permanently moves from the home, or the property is sold. Sounds great right? However, instead of you paying the bank so that the equity in your home growing, it's the exact opposite and your equity shrinks. It is basically financing your retirement with the equity in your home until there is nothing left and you pass away or move.

Home Equity Loan vs Reverse Mortgage

A home equity loan allows you to convert equity in your home to usable funds, either as a credit line or a lump sum, that is paid back at a fixed rate. Unlike the Reverse Mortgage, you do not have to be age 62 or higher to obtain a home equity loan. A Home Equity Loan matures when the borrower moves out of the house, passes away, or does not pay their homeowners insurance or property taxes, which is similar to a Reverse Mortgage.

Pros and Cons of Reverse Mortgages

Reverse Mortgages have a number of advantages, and equal number of disadvantages. They do not interfere with Medicare or Social Security payments. They provide income regularly, whether, in the form of credit or monthly payments, funds are tax-free, and spouses are not liable for the debt of the mortgage upon death. The disadvantages of a reverse mortgage are that you cannot leave a home to your heirs without their having to pay off the loan, they do not have fixed rates of interest, so the interest can accrue beyond what you planned for, application fees can be expensive from origination fees to closing costs and it is possible to outlive the equity in your home, and should you need to move out of your home, the loan will become due.

Buying and Selling a Home with Reverse Mortgage

Selling a home with a reverse mortgage is similar to selling a home with a normal mortgage. An owner will keep the remaining equity and the lender will take the mortgage loan balance. If you are purchasing a home with a reverse mortgage you will take on a loan product called a Home Equity Conversion Mortgage, or a HECM.

As you are considering your retirement and your options, the reverse mortgage may be one of the options that you may come across. In fact, they are heavily advertised, but do not be fooled by offers for this type of financing. Be certain to consult a Realtor, to get as accurate a value of the equity in your home as possible. Speak to a lawyer and if possible to a financial planner and a trusted family member to assess the best options for your future, and the future of your assets

Leave A Comment