Think home prices in the Triangle will be falling? Think again. The past two years have witnessed incredible equity gains nationwide and in some areas, well in the double digits. Prices must slow, right? The increase in interest rates will slow down buyers, right? We address these questions regularly with our clients and the indicators point to continued gradual gains in equity and interest rates that are likely to increase, but home prices are far from at a free fall. Let's discuss.

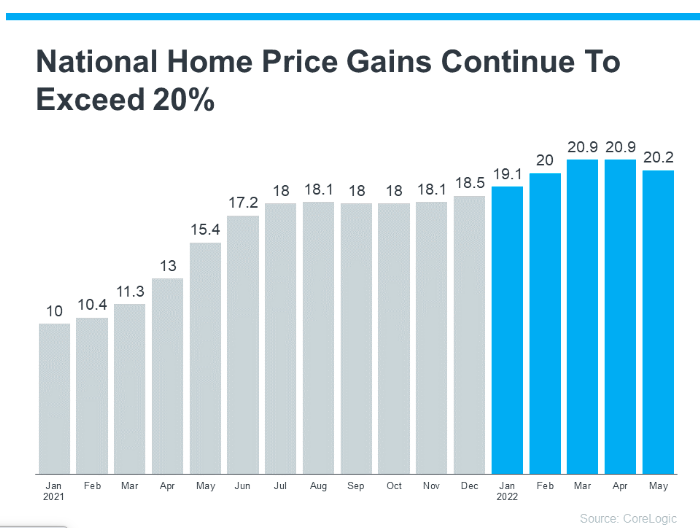

Home Price Appreciation 2022 vs 2021

According to data from CoreLogic, the rise in home prices over the past year and a half show a dramatic increase in the rate of home price appreciation in 2021, where home prices are still rising in 2022, they show a more gradual trajectory and pace. In 2021 demand was extremely high and supply was quite low, and as we enter into 2022, we see increases in inventory as the supply chain shortages ease, and interest rates increase, so a slower increase is expected.

Where will prices go?

A few expert economists weigh in on where they see home prices going in 2022.

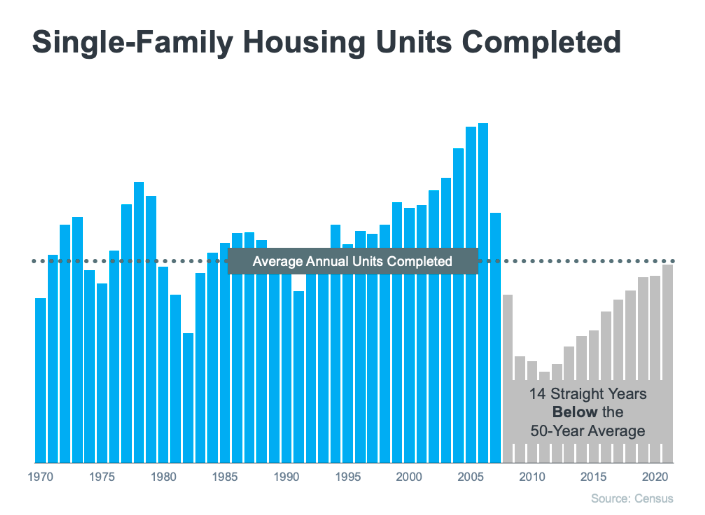

Mark Fleming, Chief Economist at First American, explains inventory as, “Still well below normal levels and that’s why even with the pullback in demand, we still see house prices appreciating. While there is slightly more inventory, it's still not enough. When there are still inventory shortages, experts project a more moderate rate of home price appreciation Expert economist Selma Hepp, Deputy Chief Economist at CoreLogic, posited that, "The current home price growth rate is unsustainable, and higher mortgage rates coupled with more inventory will lead to slower home price growth but unlikely declines in home prices." Specifically The Research Triangle Market in total saw a 17.8% increase in the median sales price of a home year to date through June 2022. This leads us to believe that the likelihood of seeing home prices drop in any significant manner is slight.

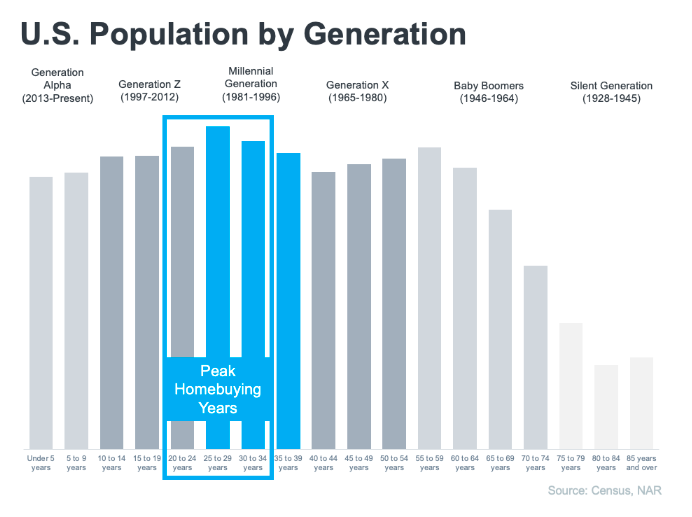

Who are the Buyers? Millennials

MIllenials have hit their peak home buying years during the pandemic, and they comprised the majority of buyers. Their demand drove up prices as buyers competed for homes and generated demand for new homes. Millennials are going nowhere either. They have buying power and will continue to dominate the buyer market, whether or not interest rates increase.

By all accounts if you are ready to sell, sell now, and if you are looking to buy, buy before rates go up. If you have reservations about how you should handle timing and your real estate portfolio, call an expert. We have over 50 years combined experience in preconstruction and existing home sales in The Triangle, we understand long term financial strategies to protect your interest. Contact us today.

Posted by Larry Tollen on

Leave A Comment