What's Ahead For Home Prices?

This fall has been a rocky one for financing. With the federal reserve continuing to raise interest rates, borrowers are facing more higher financing costs than in the past several years. We understand that there is a lot of uncertainty in today's market and wanted to share the latest perspectives from economists. Much of our content regarding market fluctuations discusses historic trends in housing and economics and we want to reinforce that when other sectors of the market are more volatile, it does not necessarily mean that housing suffers as well. Let's look at what the market is doing and what the experts are forecasting.

What goes up must come down

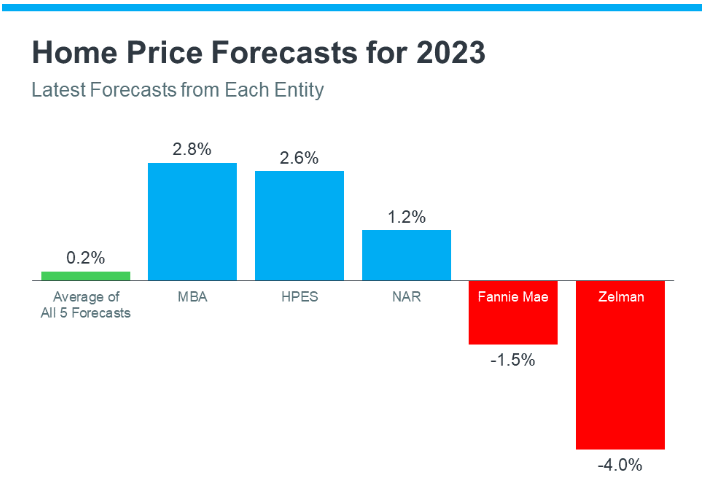

Interestingly and not necessarily very reassuring are mixed reports from expert forecasts. In 2023, the National Association of Relators forecasts an increase in home prices by 1.3%, The mortgage brokers association predicts an increase of 2.8%, but Fannie Mae predicts a decrease of 1.5% and Zelman predicts a decrease of 4%. While not varying by a lot it's hard to argue that it is a mixed bag of forecasts. If we look to another forecast, the Wells Fargo forecast extended beyond 2023 and predicted that prices will depreciate slightly in 2023, but will recover and net positive in 2024. Further, according to a Home Price Expectation Survey (HPES) from Pulsenomics, that polls over a hundred experts estimate an appreciation of roughly 2.6 to 4% from 2024-2026. As you consider these forecasts keep in mind these are national forecasts not local and as we've written many times in the past, "There is no national real estate market, real estate is always local."

What goes down must come up!

Experts looking at longer-term projections are thinking that prices will depreciate in 2023, but will recover by 2024-2026. Let’s discuss why we would see depreciation and why that should not stop you from transacting in real estate. Why is there depreciation and how could it come back up? With mortgage rates topping off near 7% to offset inflation and more homes coming to the market, home values begin to depreciate. Unlike in 2008 when we saw a lending crisis, lenders are being incredibly cautious. This is one reason why we do not think this could lead to a housing crisis. Locally here in the Research Triangle market due to its incredibly strong and growing economy we would be very surprised to see prices drop by more than 5% at the most. Currently we suspect that in 2023 we will see prices continue to appreciate slightly {2-4%} and in 2024 we expect prices to appreciate 5-10%.

Are you thinking about buying or selling a home and feeling like you need to wait it out? We would not suggest it. The Research Triangle Park is only growing thanks to its robust job market, universities, and high livability. We have buyers for your home and if you are needing to sell, it is still a great time. You just have to price your home correctly and manage your expectations. Would you like to know what your home is worth in today's market? Contact us today!

Posted by Larry Tollen on

Leave A Comment