.jpg)

The past two years have presented a number of unpredictable conditions for the housing market, confounding experts, and novice housing observers. What do you get when you add global supply shortages, labor shortages, a rapid shift in buyer preferences, to a housing market in short supply? Moreover, what also should we expect with regard to inflation and mortgage rates? Is the recent surge in demand and pricing indicative of a boom or are we in for a big bust? Should I buy or sell right now or wait this out? In this Blog, we are going to take a look at the past to give insight to the current housing market. Be sure to check out the link below to last weeks Blog to see what we believe the future holds for home prices here in the Triangle

What are the Current Market Conditions

After shelter in place orders were put into effect causing many months of global supply chain disruptions and then lifted earlier this year; we continue to have issues throughout the supply chain in both goods and labor as directly related to the real estate market. More significantly there's been a marked change in terms of our preferences for homes. While locally home prices had been steadily increasing due to high demand and low supply; as soon as the mandates lifted, residential real estate prices soared and buyers were buying homes in suburban markets at record paces. As buyers, we want more space, in less dense cities, and homes that are sustainable. As sellers, we are looking to take advantage of the seemingly insatiable demand from buyers, taking advantage of low interest rates. The local market is one of bidding wars, price increases, and continued supply chain challenges, leading many of our clients and customers to wonder, are we in a boom or bust cycle? We wanted to take a look at the past to see what the future real estate market in the Chapel Hill - Durham - Raleigh area holds.

The Great Recession, and Repercussions

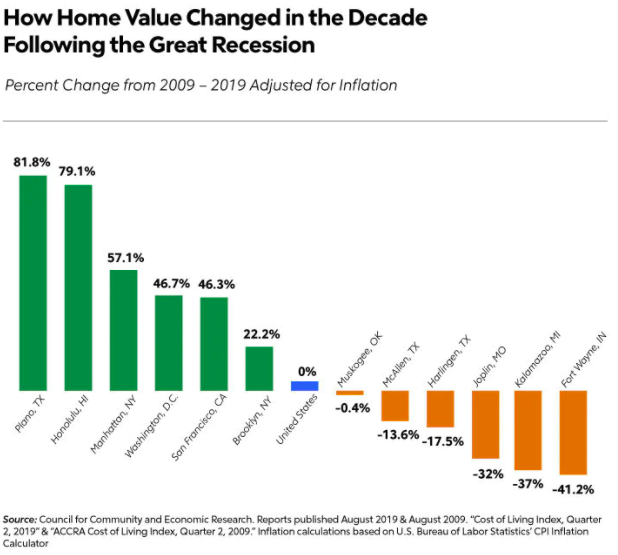

With a strong economy, a housing market should be strong, while a weak economy most often signifies a weak housing market. However right now, we are facing inflation in combination with a strong housing market. What does that mean? During the great recession, as witnessed in the accompanying graph, you can see this correlation was not present. If we compare home values in the second quarter of 2009, during The Great Recession, to the second quarter of 2019, we find that the national housing market recovered but did not appreciate. There is an extreme disparity in how home values had changed during that 10-year period, with the U.S.'s most expensive cities growing while in many of the least expensive cities, homes hadn't rebounded, further, the depreciationfrequently didn't correspond to the area's cost of living.

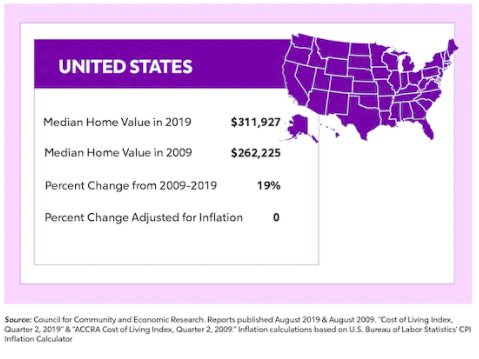

So what happened following the Great Recession? Following the housing bubble burst and the financial crisis, many Americans defaulted on their mortgages and were forced into foreclosure. After 18 months, the downturn finally came to a close at the end of the second quarter of 2009, but the value of homes were still very low. In a period of ten years, the US was in a period of economic expansion but experts were uncertain whether home values had appreciated. The following graphic shows whether the housing market recovered by reviewing how home values changed in U.S. cities between the second quarter of 2009 and the second quarter of 2019.

How Inflation Impacts Housing

During the ten year period from 2009-2019, the Gross Domestic Product increased by 49%, and the unemployment rate decreased by 5.8%. These incredible gains were not reflected in the national housing market. Why? Because inflation increased by a total of 19%. While it appears that national home values rebounded in the decade after the 2008 recession, the $50,000 increase in median home values across the U.S, was predominately a result of inflation. Property values did not truly appreciate in the decade following the Great Recession.

What is different NOW?

There are some significant differences in the Covid Era Recession and The Great Recession. Since we experienced a pandemic, the government intervened to insure there would not be an influx of foreclosures. There are far fewer distressed properties on the market right now. Secondly, lenders were forced to operate under new regulations and have learned valuable lessons from The Great Recession.

Prior to 2009, lenders were lax (often times criminally) about credit requirements and permitted borrowers to take out loans when the reality was not all of these borrowers were qualified. Many of these borrowers had loans that were interest only, thus, when defaulted on, home values took a huge hit, as homeowners had no equity built up in their homes. Lastly, Buyer preferences and low interest rates have continued to drive demand in suburban markets where inventory often remains low causing prices to continue to rise. We are working from home and no longer driven to live in cities.

Have we learned from The Past?

Lenders learned to tighten up their lending policies while our mortgage interest rates(at least for the time being) remain low. In The Triangle, we are seeing a hot sellers market and new builders developing projects in an attempt to me the demand the Research Triangle area is experiencing. Builders and lenders are no longer offering loans to those who aren't well qualified. In terms of whether we are in a bubble, most experts would argue that we are in the midst of preference changes and market conditions need to be evaluated on a case by case and location by location basis. The local market's future looks extremely strong economically and home values are expected to continue their upward trend.

Are you looking to buy or sell on The Triangle? We are happy to advise you on the current conditions for selling your home and moving to another home, area, or apartment. In our over 60 combined years of experience, we are experts in the local market and look forward to sharing our experience with you.

Posted by Larry Tollen on

Leave A Comment