We are officially on the back half of 2022 and everyone is wondering, what will happen with housing in the final part of 2022. Some speculate that inflation and new home shortages indicate a recession and housing slow downs. We compiled some of the predictions from leading experts on this topic and are sharing them to help our buyers and sellers make better decisions regarding real estate in 2022.

Inflation and Mortgages

Mortgage rates have risen 2% due to the Federal Reserve’s response to rising inflation. If inflation continues to rise, mortgage rates will respond. Greg McBride, Chief Financial Analyst at Bankrate, explained that “Until inflation peaks, mortgage rates won’t either. Without improvement on the inflation front, we don’t know where the interest rate ceiling will be.”

If you are financing making a move is very important to lock in mortgage rates that are still on the low side. Many of our clients forget that these rates are relatively low, but you should act quickly to lock in the current rate.

Inventory

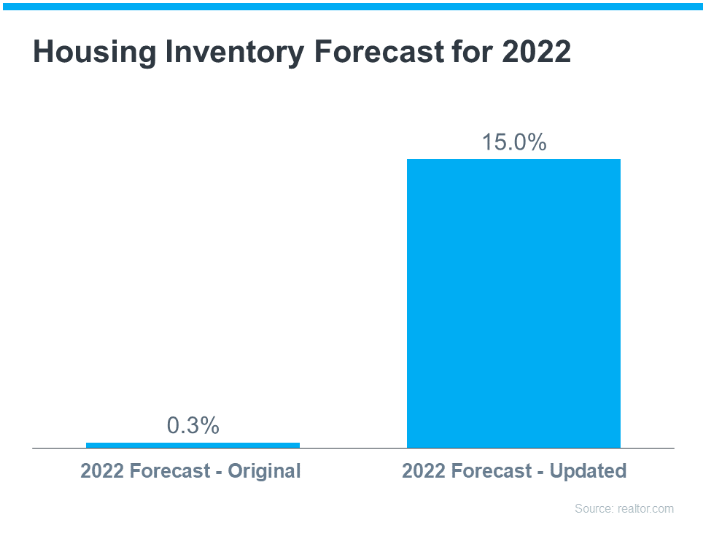

According to a realtor.com 2022 updated survey for inventory, they increased their projections for inventory gains dramatically, going from a 0.3% increase at the beginning of the year to a 15.0% jump by the end of 2022. Many of these increases is the result of new construction and we really see a lot of buyers looking for the many new construction opportunities, because the existing homes are simply not on the market.

Appreciation

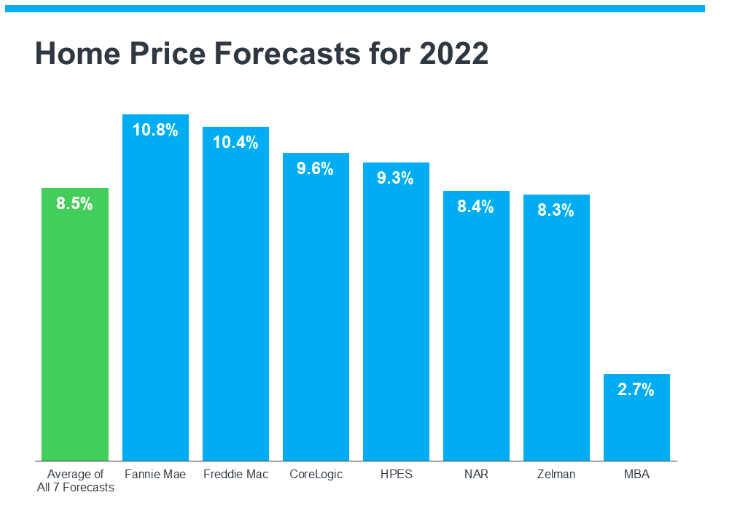

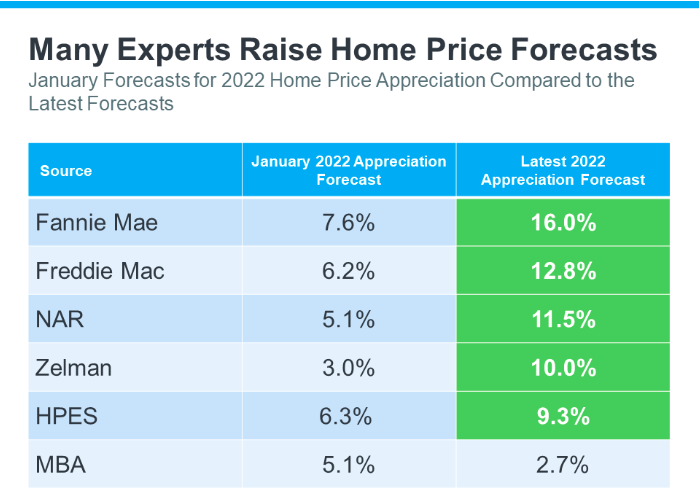

Again, many Realtors expect that homes will appreciate, but slower than the often over 20% in the past two years. According to CoreLogic, homes appreciated by 15% in 2021, and they’ve continued to rise this year. While the housing supply in the Research Triangle area is slowly increasing, we are seeing more Millennials coming to their peak home-buying age and it creates sustained pressure upwards on home prices. Experts anticipate continuing appreciation, which is projected to grow 8.5% in 2022. Selma Hepp, Deputy Chief Economist at CoreLogic, explained why the housing market will see deceleration as opposed to depreciation, “The current home price growth rate is unsustainable, and higher mortgage rates coupled with more inventory will lead to slower home price growth but unlikely declines in home prices.”

What should your real estate move be now?

These might not seem like clear indicators to move in one direction or another, but consider that as a seller, you may be tempted to wait until your home appreciates, however whether you decide to wait or list now, pricing it properly to start and getting highly visual online marketing are vitally important. As a buyer, you might decide to wait until there is more inventory, however in the Research Triangle market we don't think increased inventory is as likely as increasing mortgage rates. These reports and surveys support BOTH buying and selling now. Sellers should not delay waiting to list their homes because interest rates may make borrowing too expensive and conversely, buyers should take advantage of the current rates. If you are considering buying or selling in The Triangle, please do not hesitate to reach out.

Posted by Larry Tollen on

Leave A Comment